researchub

这是一个投研平台,本质是jupyter lab;

我对该模块的定义是存放,我们数据分析的各类notebook文件,以及各种测试代码,相关回测逻辑,请阅读plutus.research模块;

目前有如下demo:

├─0 Build Ideas

│ quantization.emmx

│

├─1 Data

│ ├─data_collection

│ │ export_data_from_clickhouse_to_arrow.ipynb

│ │ export_data_from_clickhouse_to_parquet.ipynb

│ │ export_data_from_clickhouse_to_parquet_by_sql.ipynb

│ │ import_data_from_parquet_to_clickhouse.ipynb

│ │

│ └─data_wrangling

│ │ alter_raw_data_clickhouse.ipynb

│ │ commercial_data_to_clickhouse.ipynb

│ │ download_data_to_parquet.ipynb

│ │ drop_duplicate_data_clickhouse.ipynb

│ │ pretreat_data_to_clickhouse.ipynb

│ │ proccess_data_to_clickhouse.ipynb

├─3 Research

│ ├─cross_section_factor_analysis

│ │ cs_factor_analysis_demo.ipynb

│

│ ├─investment_portfolio

│ │ factor_portfolio_analysis.ipynb

│ │ investment_portfolio_analysis.ipynb

│ │ signal_portfolio_analysis.ipynb

│ │

│ └─time_series_factor_analysis

│ example.ipynb

│ ts_factor_daily_demo.

│ ts_factor_min_demo.ipynb

│

└─5 Trader and Oversight

单因子分析流程(供参考)

引入相应模块

# coding: utf-8

import pandas as pd

import numpy as np

from plutus.research.backtest.backtest import BacktestCS

from plutus.utils.visualization.plot import PlotCS

np.set_printoptions(suppress=True)

pd.set_option('display.float_format', lambda x: '%.5f' % x)

读取数据

datapath='../../../datahub/raw/cn/stock/md/all_1d.parquet'

data_bfq=pd.read_parquet(datapath)

对数据进行基本的处理

open_ = data_bfq["open"].unstack()

close = data_bfq["close"].unstack()

high = data_bfq["high"].unstack()

low = data_bfq["low"].unstack()

vol = data_bfq["volume"].unstack()

amount = data_bfq["amount"].unstack()

#去除涨跌停,去除停牌股

# tradeable=data_bfq['amount'].apply(lambda x :1 if x>0 else np.nan)*(data_bfq['high']-data_bfq['low']).apply(lambda x :1 if x!=0 else np.nan)*chg_1_d.stack().apply(lambda x :1 if x<0.100 else np.nan)

# tradeable=tradeable.unstack()

#获取基准

# benchmark

merge_data=pd.DataFrame()

# #megedata["period"]=close.pct_change(1).shift(-1).stack()#以收盘价交易

merge_data["period"]=open_.pct_change().shift(-2).stack()#以开盘价交易

merge_data = merge_data[np.isfinite(merge_data).all(1)]

定义一个因子

def factor_simple():

factor=-1*Close.pct_change(5)

return factor

test_factor=factor_simple()

计算factor_rank

backtest_cs= BacktestCS()

clean_factor_data= backtest_cs.cal_factor_rank(merge_data,test_factor)

计算fator_quantile

clean_factor_data= backtest_cs.cal_factor_quantile(clean_factor_data,group_num=20)

选择自己需要的hold_portfolio

long_portfolio_data, short_portfolio_data =backtest_cs.cal_hold_portfolio(clean_factor_data, hold_num= 1)

计算标的权重,可以自己拟定

portfolio_data = backtest_cs.cal_portfolio_weight(long_portfolio_data)

计算回测指标

ret_df, sharpe_ratio, annual_return, max_down= backtest_cs.describer_01(long_portfolio_data,short_portfolio_data)

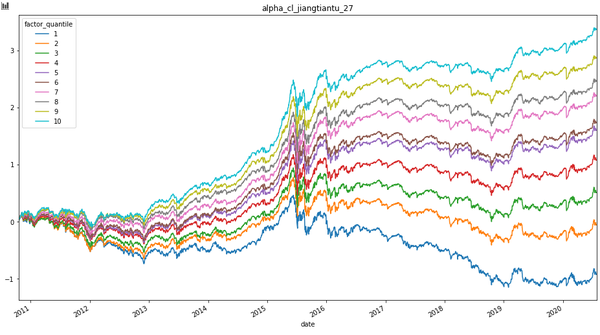

画出分组累计收益

PlotCS.plot_group_cumsum_pnl(clean_factor_data)

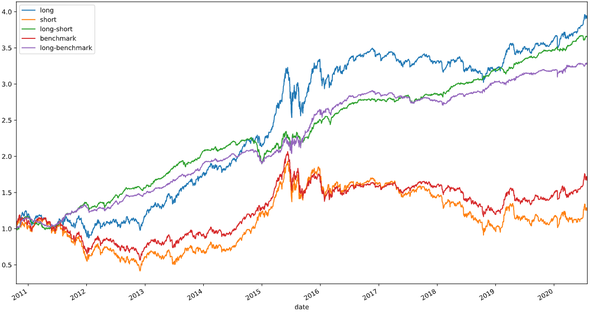

画出long-short多空收益

ret_df.plot(figsize=(16, 9), title="test")

基本上你自己定义一个因子,之后就直接开始研究了。我这个框架是学习alphalens写的,因为alphalens 太慢了,所以,就自己实现了,要快些。没有做任何封装,理解起来容易些。所有曲线没有计算手续费,没有计算对冲成本。

投资组合流程(供参考)

引入相应模块

# coding: utf-8

import plutus.research.backtest.backtest as ba

import pandas as pd

import numpy as np

import empyrical as empl

import matplotlib.pyplot as plt

from plutus.portfolio.portfolio_cal.portfolio_base import PortfolioBase

backtest_cs=ba.BacktestCS()

portfolio_base =PortfolioBase()

读取行情数据

all_1d_df = pd.read_parquet("../../../datahub/raw/cn/stock/md/all_1d.parquet")

all_1d_df.set_index(["trade_date", "code"], inplace=True)

all_1d_df['ret_1d']= all_1d_df['close']/all_1d_df['pre_close']-1

all_1d_df.head()

读取signal数据

all_1d_df = pd.read_parquet("../../../datahub/raw/cn/stock/md/all_1d.parquet")

all_1d_df.set_index(["trade_date", "code"], inplace=True)

all_1d_df['ret_1d']= all_1d_df['close']/all_1d_df['pre_close']-1

all_1d_df.head()

计算每日收益

all_pnl_1d_df = all_signal_df.groupby(['name','trade_date'])['pnl_1d'].mean()

all_pnl_1d_df=all_pnl_1d_df.unstack().T

all_pnl_1d_df.dropna(inplace=True)

all_pnl_1d_df.head()

筛选出需要的因子(有未来数据)

calmar_ratio_df= portfolio_base.cal_calmar_ratio(all_pnl_1d_df)

select_s = np.where(abs(calmar_ratio_df)>0.5,1,np.nan)

selected_pnl_1d_df = all_pnl_1d_df.mul(select_s,axis=1)

计算因子组合权重(有未来数据)

portfolio_weight_s = portfolio_base.cal_weight(selected_pnl_1d_df)

portfolio_weight_s

计算组合净值收益(有未来数据)

net_s = all_pnl_1d_df.mul(portfolio_weight_s).sum(axis=1)

net_s.cumsum().plot()